Founded in 1999, The Instant Group rethinks workspace on behalf of its clients, injecting flexibility, reducing cost and driving enterprise performance. Instant places more than 7.000 companies a year in flexible workspace such as serviced, managed or coworking offices workspace (Instant Offices hosts more than 12,000 flexible workspace centres across the world). The Instant Group employs 230 experts worldwide. We asked John Williams, Head of Marketing of The Instant Group, about his vision of the evolution of the international flexible social workplace market.

How is the conventional property market anticipating the rise of the demand for flexible workplaces?

John Williams, Instant Group

We are witnessing a seismic change in the flexible workspace market.

Clients are demanding more from their office space and the growth in operators is serving this increasing and changing demand. Landlords are entering the market with a variety of flexible office solutions and there will continue to be consolidation of the market where there are opportunities for growth and a shift to an outsourced office model.

There is a clear difference in terms of market maturity between the UK, a handful of digital startups friendly metropoles (Paris, Berlin or Dublin), on the one hand, and the rest of the continent, on the other hand. Does coworking only fit with dense urban environments?

Defining the differences in flexible working is critical, as coworking only makes up a small percentage of the market. Flexible workspaces offer all types of space including dedicated private offices, hybrid space and coworking. The growth of flexible workspaces and coworking will continue as companies of all sizes adapt and demand greater agility and flexibility with reduced risk. In terms of specific location growth, there are some factors which could make other European city contenders against London; largely whether Brexit will mean businesses no longer want to retain their portfolios in the UK. Some businesses may seek a flexible solution in a key European city, with Dublin already being the European headquarters for some of the largest tech companies such as Google, Facebook and Paypal. Whilst markets such as Paris and Amsterdam continue to go from strength to strength seeing consistent growth, attracting a range of companies into the flex market as well as seeing an increased range of operators in these cities. Whilst London continues to be the most mature European market, other key cities are beginning to really tap into flex space with an abundance of new centres and operators launching in the market.

Defining the differences in flexible working is critical, as coworking only makes up a small percentage of the market.

Is the move supported mainly by coworking “multinationals” or by independent local operators?

The three largest providers of serviced office space in London in 2017 only made up 17% of the total market with a huge number of niche providers. These smaller operators cater for unique but growing segments of the market such as specialist TMT space or women-only centres. As we have seen in the US, the number of smaller operators, who run only one or two centres, has continued to proliferate despite the growth of the larger players and represent a large proportion of supply to the market.

The three largest providers of serviced office space in London in 2017 only made up 17% of the total market with a huge number of niche providers.

Are traditional business centers all getting in and supporting the growth in offering?

Whilst the initial response was sceptical, many traditional landlords are beginning to see the benefits of flex space within their workspace. According to the Financial Times, increased client demand for flex space is having a significant impact on UK landlords. As business demand for greater agility grows and the size number of requirements increases to all-time highs, in fact the number of deals done across London for 20+ desk requirements is up a staggering 46% in the last year alone.

Traditional landlords are seeking a new route to cater for this demand; Instant recently complete a first of its kind with a co-lease solution with landlord, Dorrington, for a client seeking a larger desk requirement.

The number of deals done across London for 20+ desk requirements is up a staggering 46% in the last year alone.

How does pricing and amenity provision compare, and what do you expect to be the respective USP’s (Unique Selling Proposition) ?

Service, Calibre of space, Quality of physical space, Additional amenities, Gyms on site, Community aspect and network (WeWork, The Wing, etc.). Much like many other models; the higher the calibre of the amenities, the higher the pricing. However, desk rates are continuously climbing in correlation with increased demand. We have commissioned a number of surveys over the last 24 months with our vast occupier database. They are seeking workspaces with amenities more akin to a hotel environment with gyms, creches’ and yoga spaces to name just a few – and operators are listening.

They [occupiers] are seeking workspaces with amenities more akin to a hotel environment with gyms, creches’ and yoga spaces to name just a few – and operators are listening.

What are, according to you, the other growth areas – and the reasons why we think they are going to expand ?

Events, meeting rooms, gyms etc, concessions (pop ups, etc)… Operators are beginning to diversify and add value to existing clients; for example WeWork has begun providing pop-ups for retailers within their locations, providing a one-stop shop for occupiers. Other ventures include single use meeting rooms. Within the wider market, adding value with improved or innovative amenities will help operators stand out from the crowd.

What could slow or stop the expansion dynamic ?

There are several key trends that will significantly shape the future of what is still a nascent industry. The flex market is only 30 years old, at most, but the majority of its growth has come in the past decade with supply ramping up and more operators joining the market. This rapid growth and increasing interest in flexible solutions from the more traditional side of the property sector is already creating issues that the market will have to address. As competition grows across the market and is compounded by increased cost to operators of taking space, square meters allocation per desk has fallen dramatically to ensure margins are retained. We have also witnessed consolidation of the market through a number of acquisitions. In APAC, WeWork has been acquiring a number of local operators including Naked Hub and Space Mob. There are over 5.000 centres across EMEA and we have witnessed growth of 15% in the last 12 months. A number of operators including Mindspace and WeWork have expanded their footprint in Paris, Berlin, Amsterdam, and Tel Aviv. While there is growing demand in all markets for flex space, there are a few factors which could impact the growth of the flex market : 1) Saturation of the market with too many; 2) operators, Recession / Financial down-turn; 3) Consolidation of the market.

As competition grows across the market and is compounded by increased cost to operators of taking space, square meters allocation per desk has fallen dramatically to ensure margins are retained.

John Williams will be a speaker at the upcoming Coworking Europe 2018 conference.

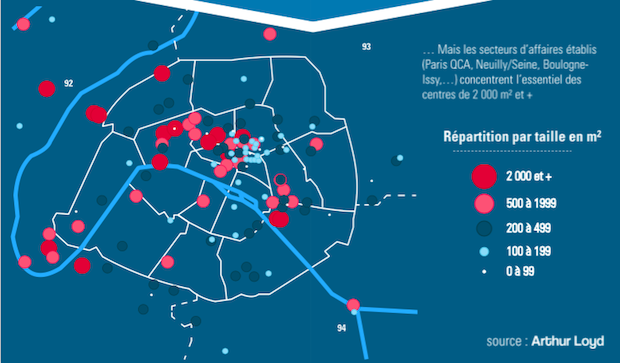

“Coworking will only absorb about 3% of the total transactions made in 2017, according to Arthur Loyd Investement. The market is generating a lot of new value, though. Landlord should take it seriously into consideration.“

“Coworking will only absorb about 3% of the total transactions made in 2017, according to Arthur Loyd Investement. The market is generating a lot of new value, though. Landlord should take it seriously into consideration.“

Contentwise, the community building activity is definitily as critical for the Indian coworking scene as it is elsewhere, show the data collected for the Survey. More than 2/3 of the Indian coworking spaces organize in house events at least once a week.

Contentwise, the community building activity is definitily as critical for the Indian coworking scene as it is elsewhere, show the data collected for the Survey. More than 2/3 of the Indian coworking spaces organize in house events at least once a week.

Recent Comments